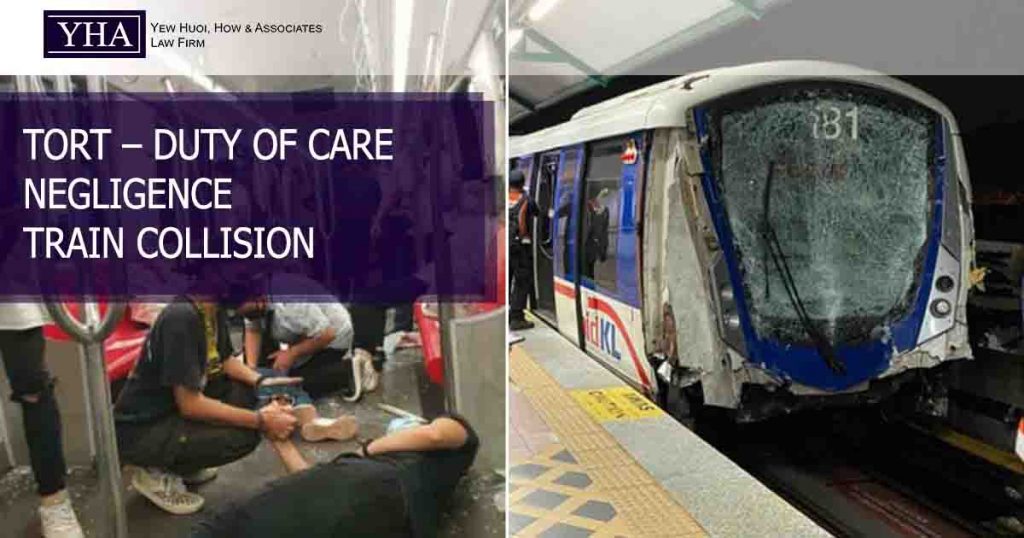

The Light Rail Transit (LRT) mishap that occurred recently has resulted in 166 passengers with light injuries and 47 severely wounded. The collision took place when a train full of passengers was running against another train that was empty that was being taken for repair.

According to the preliminary findings, the catastrophe is caused by human error. The incident is being investigated under Section 201 Land Public Transport Act 2010 for wilful act or omission endangering passengers. Alternatively, the possible avenue available to the victim is by suing the rail company for its negligence.

Q: What do I sue under the tort of negligence?

The three elements required to establish tort of negligence are :-

- duty of care owed to the victims;

- the rail company has breached such a duty; and

- the said breach has resulted/caused the victims to suffer harm.

Q: Is the duty of care owed by the rail company/train operator?

A duty of care is the legal responsibility to avoid any conduct or omissions that could reasonably be foreseen cause harm to others. The LRT is a public transportation and it is reasonably foreseeable that all its passengers will be closely affected. The train operator/rail company hence owes a duty of care to the victims and/or passengers to ensure their safety.

Q: Is the duty of care breached?

The said duty is breached when the actions/omissions fall below the minimum standard of care of a reasonable man.

In light of the train mishap, the rail company/train operator should have warrant proper scheduling of running trains in preventing miscommunications and crash. Therefore, the failure to do so amounts to a breach of the said duty.

Q: Has the breach actually caused the victims to suffer the harm?

The court will apply ‘but-for’ test to determine the causation i.e., but-for the failure of the rail company/train operator to safeguard the trains from collision, the victims would not have suffered.

The LRT company, Prasarana Malaysia Bhd said that all the victims would receive RM1,000 as compensation and issued a public apology. For victims who have suffered severe injuries, their medical bills would be borne by Prasarana until full recovery.

However, many have expressed their dissatisfactions pertaining to the amount of compensation.

Q: What are the laws governing compensation?

The types of recoverable damages are :-

- General Damages

- Special Damages

General Damages are awarded to compensate the direct effect of accidents, i.e., linked to the collision. For example, physical pain and suffering, injuries, mental injuries and mobility restrictions.

Special Damages are awarded to compensate the out-of-pocket expenses victims incurred as a result of the breach. They include medical expenses, loss of income, replacement of damaged property, transportation costs and loss of earning capacity.

Q: How do the court assess damages?

A party seeking recovery of damages such as loss of earnings must provide adequate proof. The compensation must be fair. For personal injury, the court will take into account factors such as whether the victim is the sole breadwinner, disablement, reduction of earning. It must be borne in mind that damages serve as a compensation, not a reward.

The table below is the compendium guideline used by judges and lawyers to estimate the range of quantum and damages.

Example of Injuries and Compensation

| Injuries | High – Low |

| Orthopaedic Injuries· Skull Injuries

· Broken Teeth · Arm Fracture · Arm Amputation · Hip Dislocation · Leg Amputation · Spinal Injury |

(RM)

12,000 – 30,000 2,500 – 36,000 4,000 – 30,000 9,500 – 55,000 15,000 – 40,000 7,000 – 310,000 3,000 – 420,000 |

| Internal Injuries

· Brain Injury & Impairment · Paralysis · Blindness · Organs Rupture |

(RM)

6,000 – 180,000 48,000 – 420,000 24,000 – 220,000 12,000 – 24,000 |

| External Injuries

· Extensive Scarring · Skin Grafting |

(RM)

6,000 – 36,500 12,000 – 30,000 |

| Miscellaneous Conditions

· PTSD, Depression · Tissue Injury · Burn Injury 30% – 90% |

(RM)

5,000 – 12,000 3,000 – 5,000 3,000 – 200,000 |