How do I improve my chances of getting housing loan from the banks?

There are many factors bank will consider when giving a loan. Here are the steps:

- Start building credit trust by applying for credit card or car loan.

- Ensure that your credit card bills, car loan etc are paid on time.

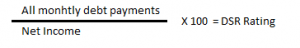

- Reduce your debt service ratio (DSR) rating based on this formula:

- Reduce your DSR to 80 or below by either reducing monthly debt payments or increase your net income. Depending on the banks you are applying to, some banks only accept DSR 50 or below.

- Monthly debt payments can be reduced by :

- Negotiating with your creditors for alternative payment plans for lesser month payment;

- Refinancing of property to extend the tenure of repayment;

- Consolidate your outstanding debt; or

- Balance transfer of your credit card debt.

- Increase your net income

- Part time job; or

- Rental of your unoccupied premises.

Every bank maintains its own distinctive policy for loan approval. If you have any difficulty in applying for housing loan or needing help to apply for loan, please do not hesitate to log on to our website by clicking here at YHA Law – Loan Application.

Send us your details and we will get our professional mortgage specialist to understand your needs and apply loan for you.